Markets

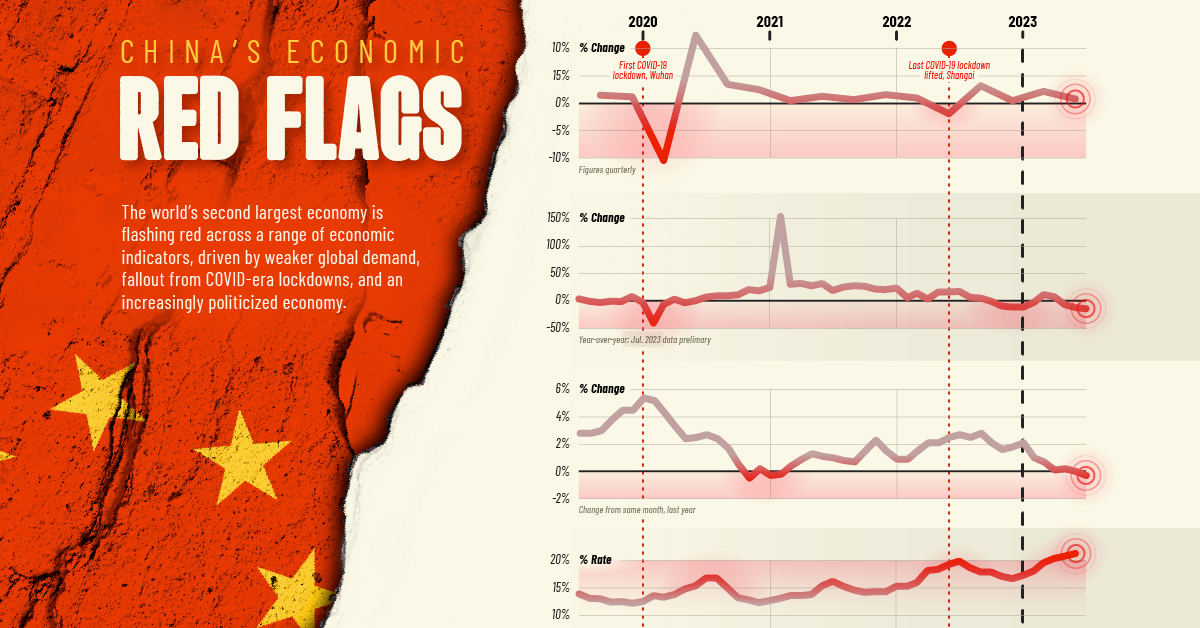

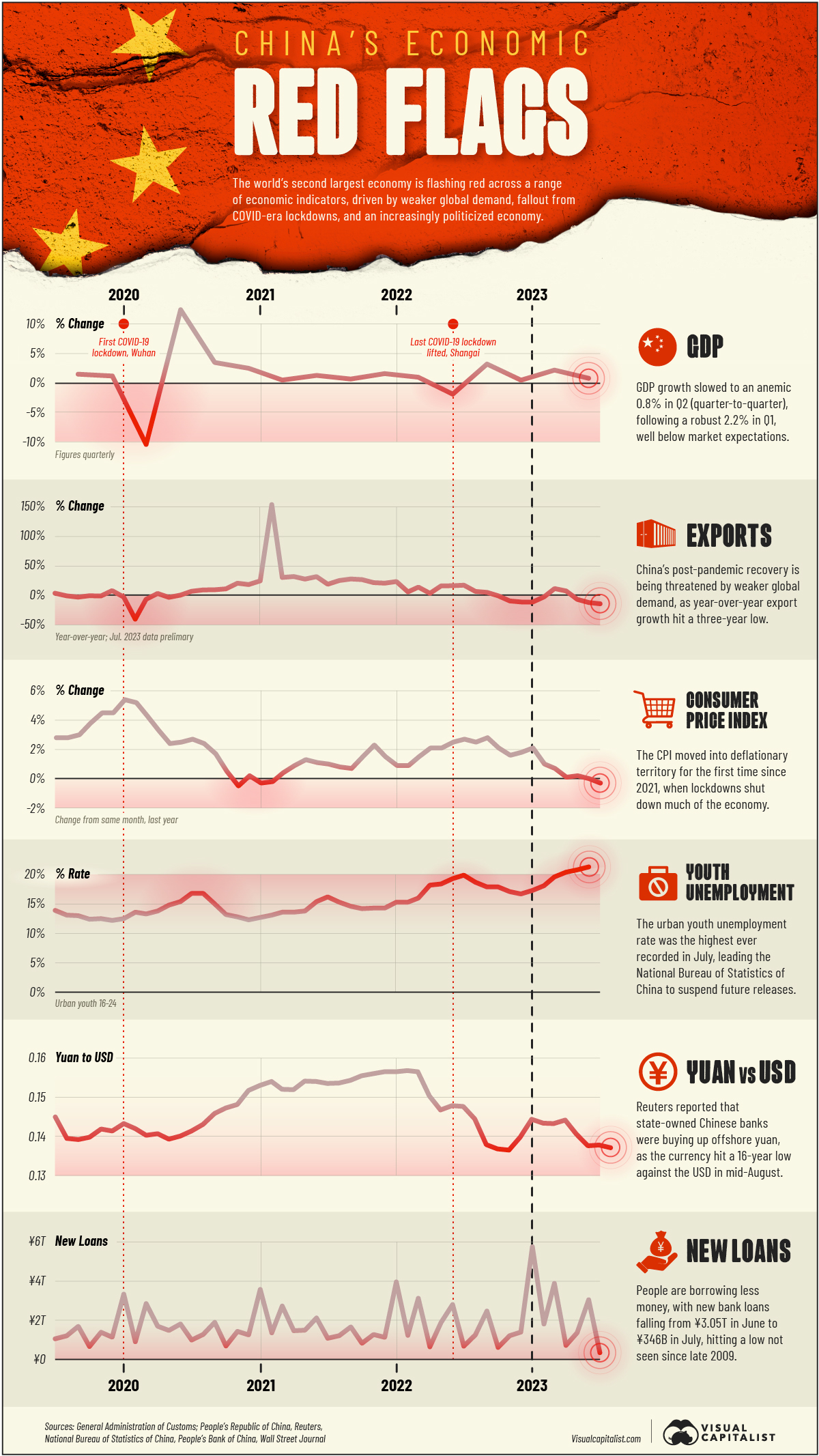

Charted: Six Red Flags Pointing to China’s Economy Slowing Down

Six Red Flags Pointing to China’s Economy Slowing Down

The People’s Republic of China is the world’s second-largest economy, responsible for one quarter of global GDP growth this millennium—so when the country catches a cold, the world notices.

The past several months have seen an avalanche of bad economic news for China, putting the country’s post-pandemic recovery, and global economic growth, in jeopardy.

In this visualization, we look at six important indicators that point to China’s economy slowing down. Data comes from the National Bureau of Statistics of China, the People’s Bank of China, and the General Administration of Customs, to see what is flashing red.

Six Red Flag Indicators on China’s Economy

1. GDP

China’s annual GDP growth rate has averaged 9% since 1978, when the country opened itself up to the global market under Deng Xiaoping.

However, growth seems to have slowed to a crawl, down to 0.8% (quarter-to-quarter) in the second quarter of 2023 driven by weakness in the Tertiary Sector, which includes retail spending and the troubled real estate sector. This follows a more robust 2.2% figure in Q1, which was driven by pent-up demand released by the end of COVID-era lockdowns.

On an annual basis, China’s GDP expanded 6.3% year-over-year, below the forecasted 7.3% rate.

2. Exports

Exports fell by 14.5% in July, marking the third straight month of declines, and hitting lows not seen since February 2020. Meanwhile, imports fell 12.4%, reflecting the cautious consumer mood.

On a regional basis, exports fell year-over-year to China’s three biggest customers, ASEAN, the EU, and the U.S., by 17.4%, 15.1%, and 20.8% respectively.

There was one bright spot, however: exports to sanction-burdened Russia increased 51.8%, but that wasn’t nearly enough to offset the overall downward trend.

3. Consumer Price Index

The consumer price index moved into deflationary territory for the first time since 2021, with prices falling 3% year-over-year. The decline was led by Household Articles and Services, Food & Tobacco, and Transportation and Communications.

At the same time, the prices that producers paid for industrial products (PPI) fell 4.4% (year-over-year), the tenth month in a row with a negative reading.

4. Youth Unemployment

And while the headline unemployment rate remained steady at 5.3% in August 2023, up slightly from 5.2% the month before, it papers over serious weakness for urban youth, aged 16 to 24.

In July, the urban youth unemployment rate reached 21.3%, the highest ever recorded in the country, leading the National Bureau of Statistics of China to suspend future releases.

5. Yuan vs. USD

Given the stream of economic bad news, it’s no surprise that the yuan fell to a 16-year low against the U.S. dollar on August 16, 2023 in offshore trading.

In an effort to stabilize the currency, major state-owned Chinese banks were seen buying up yuan in offshore money markets. At the same time, the spread between the fixed exchange rate set by the People’s Bank of China and the offshore rate, rose to more than 1,000 basis points.

6. New Loans

Adding to the dismal economic mood, people borrowed less money according to the most recent figures provided by the government.

New bank loans fell to ¥346 billion in July, down from ¥3.05 trillion in the month before. This was the lowest reading since late-2009, and less than half of the ¥780 billion economists had forecast.

What’s Next?

Foreign Affairs recently published an article with the provocative title “The End of China’s Economic Miracle,” arguing that China’s troubles could be a U.S. opportunity.

And while this may be somewhat premature, the Middle Kingdom has some serious structural issues to contend with, many of them of their own making. Some of the top challenges include crackdowns on the tech sector, a collapsing real estate market, a larger debt crisis, and a shrinking population.

But large-scale government intervention does not appear to be in the offing, beyond exhortations for consumers to spend more and blaming Western media for engaging in “cognitive warfare.”

It’s no wonder that consumer confidence has plunged so low. At least we think so: the Chinese government stopped publishing that too.

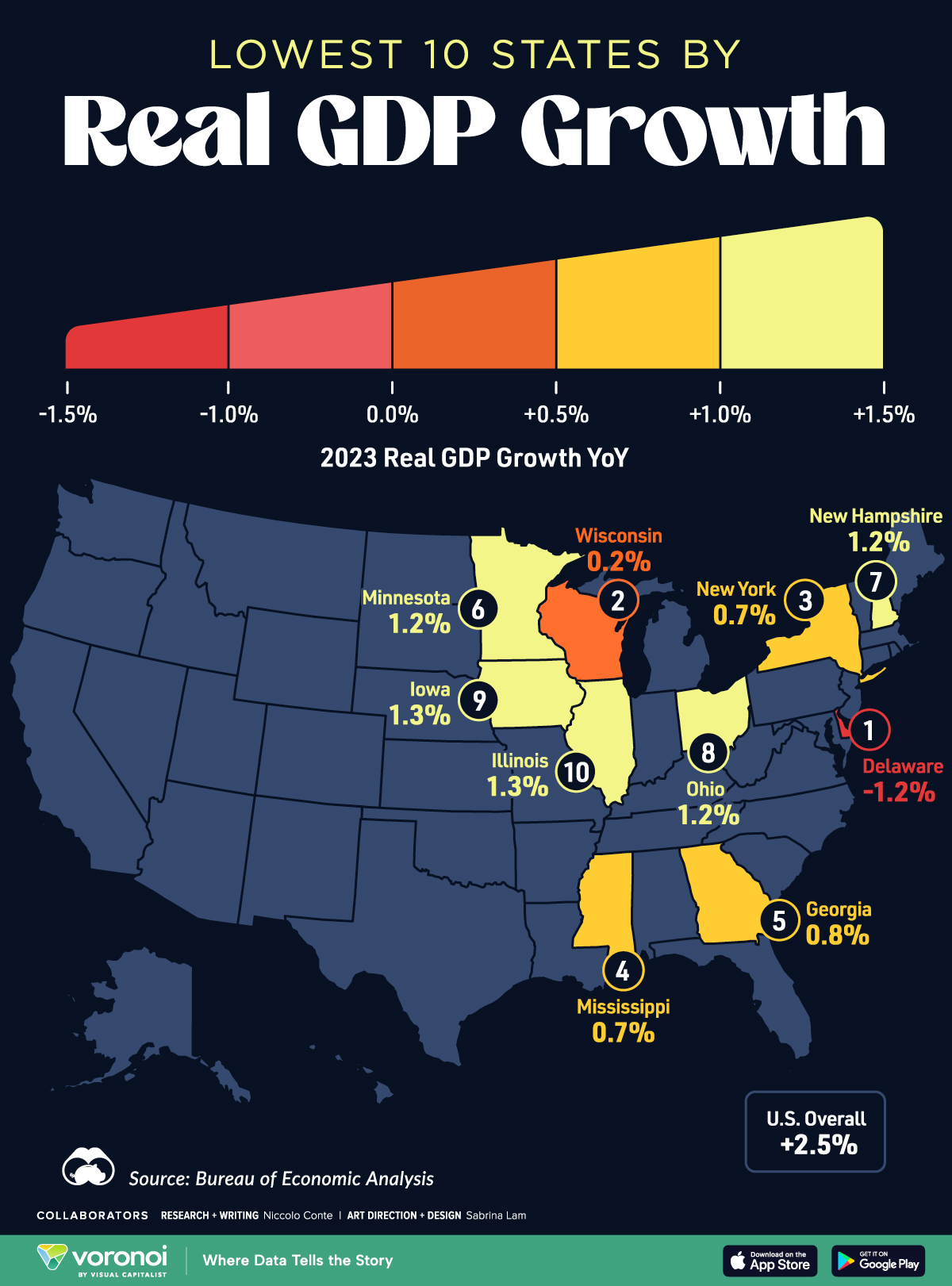

Maps

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture7 days ago

Culture7 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

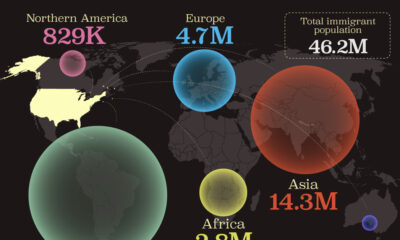

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

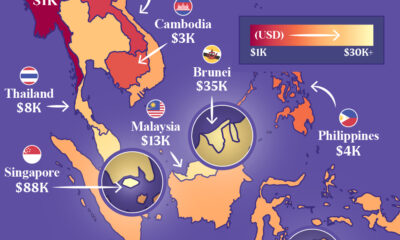

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country